WEST LAFAYETTE, INDIANA, US — With commodity prices and farm income projected to decline in 2024, US farmers expressed a more pessimistic outlook in a survey conducted in January by Purdue University and the CME Group.

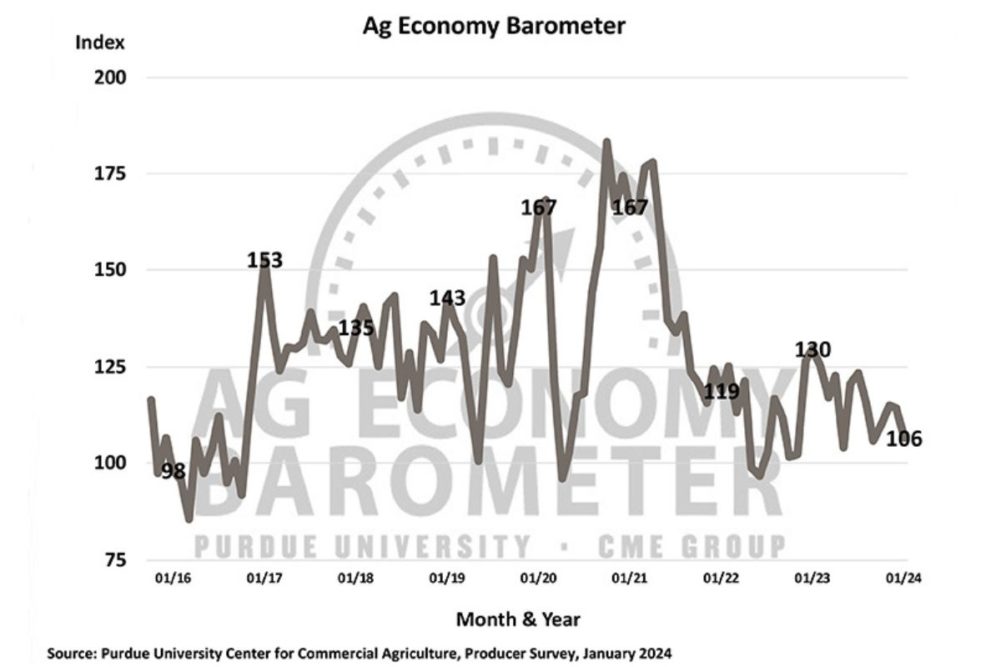

The January Ag Economy Barometer fell to a reading of 106, 8 points lower than in December. Producers expressed a more pessimistic perspective about their farms’ current situation and future prospects. The Current Conditions Index fell 9 points, and the Future Expectations Index dropped by 7, both compared to December.

The anticipation of weaker farm income in 2024 contributed to the overall decline, reflected in the Farm Financial Performance Index at 85, a 12-point decrease from the previous month. The survey was conducted Jan. 15-19.

“The number of producers pointing to lower commodity prices and lower farm income in 2024 significantly influenced the decline across all indices,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

There was an increase in the proportion of producers anticipating a decline in financial performance for the upcoming year, with the figure rising from 20% in December to 31% in January. The percentage of those expecting income levels to remain stable decreased from 63% to 53%.

“For the first time, the percentage of producers choosing lower commodity prices as a top concern matched the percentage of producers who chose higher input costs,” Mintel said. “This alignment indicates that US farmers are worried about a possible cost/price squeeze leading to lower farm incomes.”

The Farm Capital Investment Index fell to 35, 8 points lower than in December. This month, a shift occurred as fewer producers attributed their hesitation to make large investments to rising interest rates, which reversed a trend observed through much of 2023. Instead, more farmers cited high machinery and construction prices as reasons to defer investments. Meanwhile, among those deeming it a favorable time for large investments, an increased number pointed to expansion opportunities, while fewer referenced the rise in dealers’ farm machinery inventories as a motivating factor for investment.

This year, a greater number of producers expect their operating loan size to remain steady compared to last year, with fewer anticipating a larger loan. Of those expecting an increase, 61% cited rising input costs, down from 80% last year, while 23% attributed it to farm expansion, up from 15% in 2023.

While the Short-Term Farmland Value Expectations Index declined to 115, indicating reduced optimism on the part of producers, the long-term index held steady at 150, suggesting enduring optimism. Notably, the proportion of producers anticipating a decline in farmland values for the upcoming year rose to 16%, up from 10% just three months ago, with a simultaneous drop in those expecting higher values from 35% to 31%.