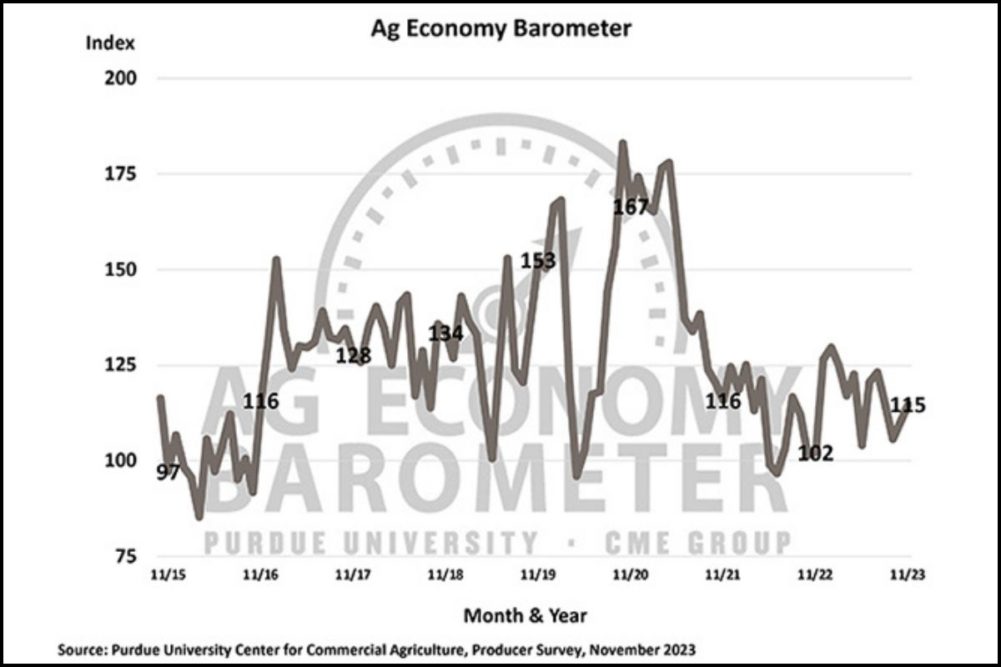

WEST LAFAYETTE, INDIANA, US — US farmer sentiment in November improved for the second consecutive month as the Purdue/CME Group Ag Economy Barometer climbed 5 points above the prior month to an index value of 115. The primary driver behind the growing optimism was improved farm financial performance expectations among survey respondents, according to the report. The survey was conducted Nov. 13-17.

The Index of Current Conditions rose 12 points to 113 while the Index of Future Expectations improved by 2 points to 116. The Farm Financial Performance Index also rose in November to a reading of 95, which was up 3 points from October. The financial index reached its low point back in the spring. The November reading was 25% higher than in May and 10% higher than at the start of fall harvest in September.

“Farmers’ expectations regarding financial performance have improved, with fewer producers expecting worse performance than a year ago,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Farm Capital Investment Index has fluctuated throughout 2023 but rebounded in November to a reading of 42, up 7 points from October. Over the last several months, producers who view the investment climate as favorable were asked why they feel that way. The percentage of respondents choosing “strong cash flows” has been drifting lower since summer when approximately 40% of respondents chose that as their primary reason. This month just 22% of respondents chose “strong cash flows” with “higher dealer inventories,” chosen by 29% of respondents, claiming the top spot as to why now is a good time to make large investments, implying a potential change in market conditions.

“This shift suggests that farmers might be seeing a moderation in farm equipment price rises, making it a more favorable time for large investments,” Mintert said.

Top concerns expressed for the upcoming year include higher input costs (32%), rising interest rates (26%) and lower crop and/or livestock prices (20%). Notably, there has been a shift in concern throughout the year, with fewer producers expressing worry over higher input costs compared to the beginning of the year. Instead, more producers are now concerned about rising interest rates and lower crop and livestock prices.

The November survey was conducted the same week that Congress voted to extend the 2018 farm bill’s provisions to Sept. 30, 2024. Anticipating the extension by Congress, the survey gauged the preferences of corn and soybean producers regarding farm safety net programs for 2024. Over two-thirds of respondents expressed a preference for the ARC farm program, while nearly one-third leaned toward enrolling in the PLC program, assuming the extension of the current farm bill’s provisions.

Despite preferences emerging, uncertainty prevails, particularly for soybean (52% declining to choose) and corn (43% declining to choose) producers when deciding to choose between programs.