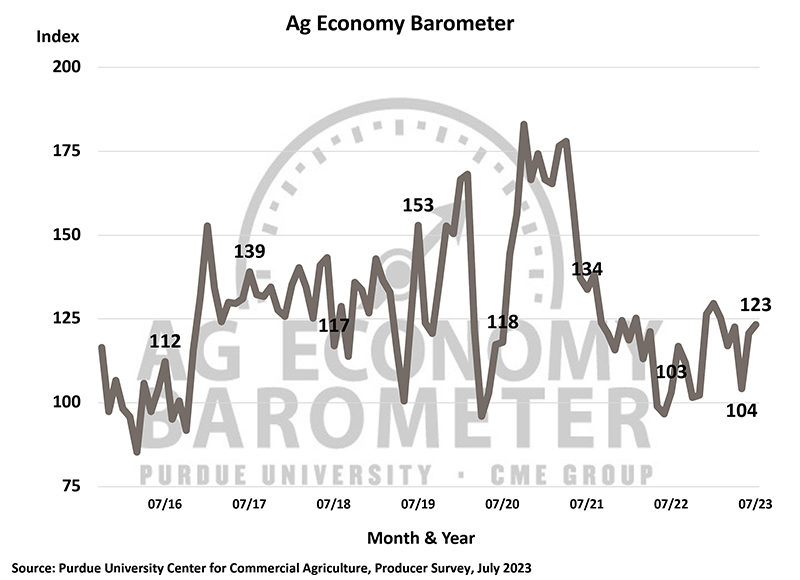

WEST LAFAYETTE, INDIANA, US — US agricultural producer sentiment improved slightly in July as the Purdue University/CME Group Ag Economy Barometer index rose two points to a reading of 123.

Farmers were also more optimistic about their perception of current conditions and future expectations on their farms. The Index of Current Conditions rose 5 points to a reading of 121, while the Index of Future Expectations was up one point to 124. The Ag Economy Barometer is calculated each month from 400 US agricultural producers’ responses to a telephone survey. This month’s survey was conducted between July 10-14.

“Producers were slightly more confident about the farming economy in July, despite recent crop price volatility and continued concerns about rising interest rates,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The improvement in farmers’ perspective on current conditions spilled over into a modest rise in July’s Farm Capital Investment Index, up 3 points to a reading of 45. However, the index has greatly improved, up 14 points, since bottoming out in November 2022. Comparing July’s responses to last fall’s low point, the percentage of producers saying now is a good time for large investments has improved from 10% who felt that way in November to 17% in July. Additionally, the percentage of farmers who feel it’s a bad time to invest was down from 79% who felt that way in November to 72% in July.

Surprisingly, the improvement in this month’s investment index occurred despite a rise in the percentage of producers who expect interest rates to rise over the next year. Nearly two-thirds (65%) of producers in July said they expect interest rates to increase, up from 57% in June. Among those who indicated that now is a bad time to make large investments, their top reason was concern about rising interest rates.

Given the volatility in commodity prices, especially crop prices, this spring and early summer, it’s notable that more producers expressed concern about rising interest rates than declining output prices. Producers’ top concern for their farming operations in the upcoming year is still higher input costs (37% of respondents), followed by rising interest rates (24% of respondents) and lower output prices (19% of respondents).

Farmers’ rating of financial conditions on their farms was virtually unchanged in July, as the Farm Financial Conditions Index rose just one point to a reading of 87. When asked to look ahead one year, there was a one percentage point increase in farmers expecting farm financial conditions to improve over the previous month and a one-point decline in the percentage of farmers expecting conditions to worsen. Farmers’ longer-term perspective on the US agricultural economy did improve somewhat in July. The percentage of respondents expecting bad times in the upcoming five years fell two-percentage points to 39% in July.