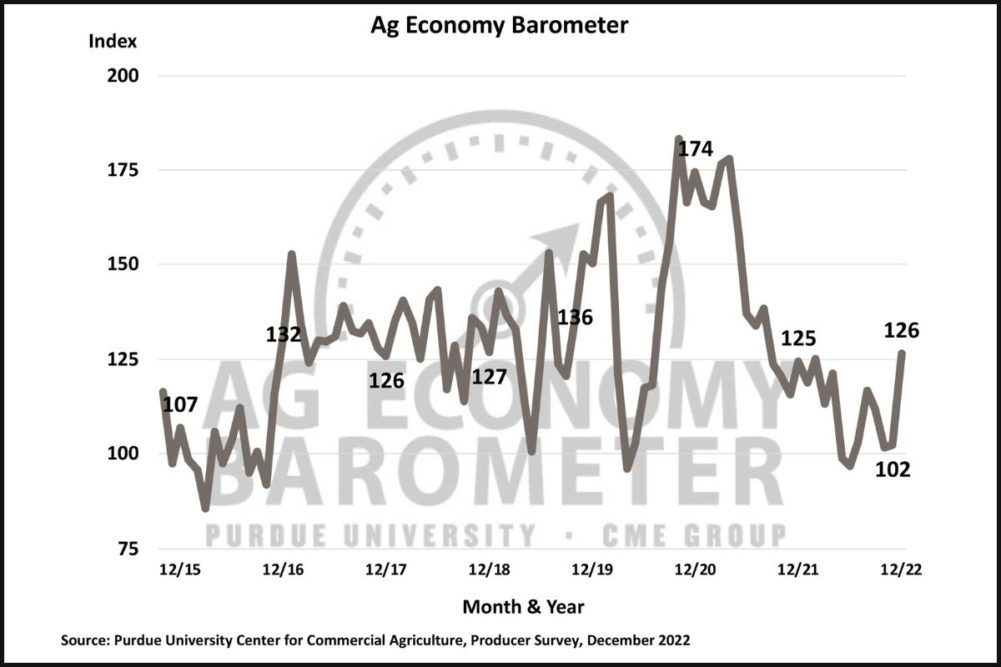

WEST LAFAYETTE, INDIANA, US —US farmers felt more optimistic about their current situation and the future as 2022 came to a close, according to the Purdue University/CME Group Ag Economy Barometer.

After a two-month decline and a year of weak sentiment, the barometer rallied 24 points in December to a reading of 126.

The Current Conditions Index jumped 37 points to a reading of 135, while the Future Expectations Index increased 18 points to a reading of 122.

“The improvement in current sentiment was motivated by producers’ stronger perception of current financial conditions on their farms and could be attributed to producers taking time to estimate their farms’ 2022 income following the completion of the fall harvest,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Ag Economy Barometer is calculated each month from 400 US agricultural producers’ responses to a telephone survey. This month’s survey was conducted from Dec. 5-9, 2022.

The Farm Financial Performance Index climbed 18 points to a reading of 109 in December. Notably, this was the only time in 2022 that the index was above 100. The turnaround was driven by a sharp increase in the percentage of producers who expect better performance than last year, which jumped from 23% to 35% of respondents, and is consistent with the USDA’s forecast for strong net farm income in 2022.

The Farm Capital Investment Index climbed 9 points this month to 40, the highest reading for the index since February; yet, it remains 9 points lower than a year earlier. Among the nearly three-quarters of respondents who said it was a bad time for large investments, the most commonly cited reason was high prices for farm machinery and new construction (41%) followed by rising interest rates (28%).

Looking to the year ahead, the December survey asked producers to compare their expectations for their farm’s financial performance in 2023 to 2022. Producers indicated they expect lower financial performance in 2023 and cited rising costs and narrowing margins as key reasons.

Concerns about costs continue to be top of mind for producers. Nearly half (47%) of crop producers said they expect farmland cash rental rates in 2023 to rise above the previous year. Other top concerns for 2023 include higher input costs (45% of respondents), rising interest rates (22% of respondents) and lower crop or livestock prices (13% of respondents).