ABUJA, NIGERIA — Nigeria is the largest economy in Africa and a major oil producer. Its grain processing sector is highly concentrated, with some of the world’s largest food sector players. The government is responding to the country’s dependence on imported wheat, the disadvantages of which have been highlighted by the effects of Russia’s invasion of Ukraine, by working to increase domestic production.

In its June 23 grain market report, the International Grains Council (IGC) put Nigeria’s total 2022-23 grains production at 21.6 million tonnes, a figure revised up from the previous month’s forecast of 21.1 million. It put 2021-22 production at 21.5 million.

The IGC put the country’s maize crop at 12.5 million tonnes, revised up from 12 million forecast a month earlier, but down on the previous year’s 12.7 million. Production of sorghum is put at 7 million tonnes, an unrevised estimate, with the previous year at 6.7 million.

Total grains imports in 2022-23 were forecast at 6 million tonnes, the same figure as in the previous month’s report, up from the previous season’s 5.8 million. Imports of wheat were forecast at 5.9 million tonnes, an unrevised figure, up from 5.7 million the year before.

The top milling companies — FMN, Olam, Dangote, Charghoury and Honeywell — control 32%, 24%, 19%, 11% and 10% of the market share, respectively, while all other small millers account for 4%.

The 2022-23 rice crop is put at 5.4 million tonnes, unrevised from May, with the previous year at 5.3 million. Nigeria is expected to import 2.1 million tonnes of rice, also unrevised, up from 2 million the year before.

According to an annual attaché report on the grains sector dated April 7, Nigeria will produce 160,000 tonnes of wheat in 2022-23, up from 90,000 in 2021-22.

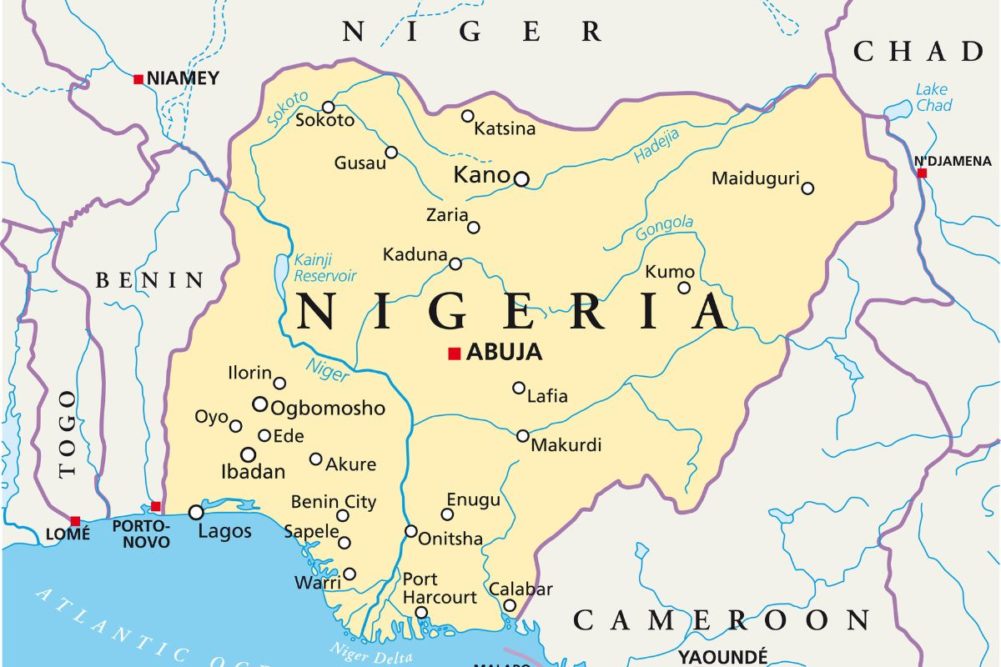

“Rainfed wheat has been successfully grown in Nigeria’s three highlands — Gembu (Taraba State), Jos (Plateau State) and Obudu (Cross River State),” the attaché said. “Wheat production in Nigeria is experiencing renewed attention from the government, the African Development Bank, and researchers. These efforts are paving the way for Nigeria to achieve self-sufficiency in wheat production.

“The Central Bank of Nigeria through its Anchor Borrowers Program (ABP) is collaborating with the Wheat Farmers Association of Nigeria (WFAN) to extend wheat production from 5 states to 15 states. The bank provides loans to support the farmers and gives seeds (with short gestation period) imported from Mexico to assist the farmers.

“The heat-resistant seeds (13,000 tonnes) imported last year by CBN have undergone multiplication in Jos, Plateau State and are ready to be distributed to the farmers. Yield per hectare is forecast to improve by 18% (1.3 tonnes per hectare) as compared to (1.125 tonnes per hectare) reported for marketing year 2021-22.”

Private companies including Olam Flour Mills, in tandem with other research institutes such as the Lake Chad Research Institute (LCRI) and International Center for Agricultural Research in the Dry Areas (ICARDA), have set up a N300 million (US$720,000) 10-year community seed project (heat tolerant variety) for Nigerian farmers to increase production of wheat and to strengthen agricultural production in northern Nigeria’s wheat farming belt, the attaché said.

In mid-July, Nigeria became the latest country to approve imports of Buenos Aires, Argentina-based Bioceres Crop Solutions’ proprietary drought-tolerant HB4 wheat variety, according to Reuters. Nigeria follows recent approvals by Brazil, Colombia, Australia and New Zealand for use of HB4 in food and feed.

The attaché forecast an increase of 3.5% in Nigeria’s wheat consumption in 2022-23.

“Wheat is the third most consumed grain in Nigeria after corn and rice,” the report explained. “The country’s population growth is driving consumption. Currently, Nigeria’s population is strongly skewed toward youth and urban areas. Nigeria’s urban population has grown steadily from 18.2% to 52% of the total population over the past 50 years. Over the past two years, Nigerian households have paid more for a range of staples — rice, varied forms garri products, yam, noodles, and bread. However, bread price hikes have been lower than overall food inflation.”

As a result, in June 2021, the Association of Master Bakers and Caterers of Nigeria (AMBCN) ordered its members to increase prices of bread and other products by 30% “due to the prevailing economic situation in the country,” the attaché said. Meanwhile, a prolonged crisis in Ukraine will further put bread out of reach of the masses and will force more bakeries to go out of business due to high operational costs — amid low consumer purchasing power.

“Bakers identify the scarcity of foreign exchange as the primary reason for the high cost of flour,” the attaché said. “Many wheat importers are sourcing their foreign exchange — especially dollars from the parallel market — about 30% to 35% more than the official rate.”

Highly consolidated milling sector

Milling companies already were reporting increased prices because of the Russian attack on Ukraine.

“Nigeria imports more than 50% of its wheat requirement from Russia and other Black Sea countries,” the attaché said. “To reduce the domestic price of wheat flour and sustain profitability, most Nigerian flour mills buy cheaper wheat from Russia, Latvia and Lithuania. Mills are enhancing their practices of blending cheaper, low-quality wheat with more expensive high-quality hard red winter from the United States.”

Nigeria’s flour milling sector is highly consolidated. In 2021, the largest company in the sector, Flour Mills of Nigeria PLC, acquired a majority stake in Honeywell Flour Mills PLC, its major competitor. Flour Mills of Nigeria has a flour milling capacity of about 12,000 tonnes a day, while the capacity of Honeywell Flour Mills is about 2,500 tonnes a day. The two companies have a combined market share of 70%.

In general, the large flour mills owned by FMN, Honeywell, BUA and Olam are highly integrated. Efficient purchasing, transporting and processing systems strengthen their competitive advantages.

The top milling companies — FMN, Olam, Dangote, Charghoury and Honeywell — control 32%, 24%, 19%, 11% and 10% of the market share, respectively, while all other small millers account for 4%. Analyst KMPG said the three largest players in Nigeria’s flour milling market account for approximately 75% of total revenues.

Well suited for soybean production

In a June 24 report, the attaché forecast Nigeria’s soybean production in 2022-23 at 1.35 million tonnes, 20% up on the previous year.

“Soybean is a crop well suited to Nigeria’s topography and ecological conditions,” the report said. “Consumption is strong due to growing demand in the food processing and feed use sectors. Food processors use soybeans to produce soy milk, soy cake, soy yogurt, and to fortify local carbohydrate-based Nigerian food staples (e.g., garri and rice).”

The same report put palm kernel oilseed production in 2022-23 at 1 million tonnes, up 11% year-on-year. The attaché said that an increase in area was driven by increasing domestic demand for palm kernel oil in food processing.

Biotech gets mixed reaction

In a Dec. 14, 2021 report, the attaché noted that “the government is advancing and commercializing agricultural biotechnology as a tool to achieve food security.”

Among crops already approved is drought- and insect-tolerant TELA maize.

“There are various factors that may limit commercialization of biotechnology in Nigeria,” the report said. “Nigeria’s NBMA (National Biosafety Management Agency) Act requires mandatory labeling of products containing genetically engineered (GE) products or ingredients exceeding 4%.

“Furthermore, civil society groups are intensifying their anti-GE campaigns. However, anti-GE messaging does not resonate with farmers, who generally have positive attitudes towards biotechnology.”

Chris Lyddon is World Grain’s European correspondent. He may be contacted at: cajlyddon@gmail.com