COLUMBUS, OHIO, US — Grain industry suppliers are ecstatic to have business booked into next year, but said during GEAPS Exchange in Columbus, Ohio, US, that they are still facing challenges with supply chain delays, labor shortages and soaring steel prices.

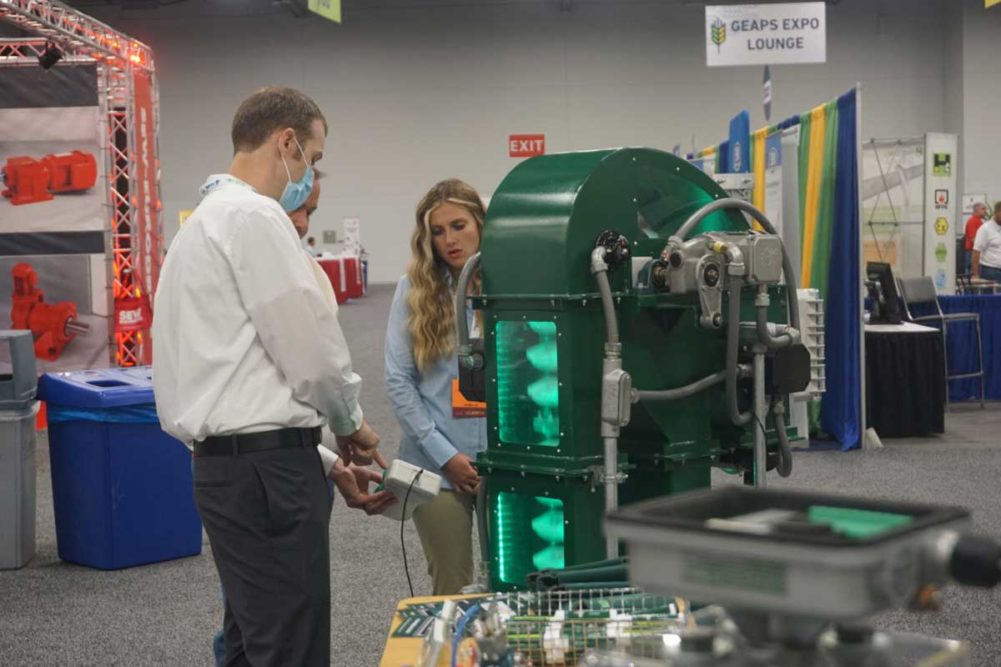

The show, Aug. 6-9, was the first in-person Exchange since 2019. Attendance was about half of normal, said Steve Records, GEAPS executive director, which was expected given the ongoing concerns surrounding COVID-19 and the change of date to late summer from mid-winter.

“What we’re really proud of is that we were able to have it, we didn’t cancel it and we didn’t postpone it,” Records told World Grain. “We’re really excited about the continued support of the industry and GEAPS. All of the exhibitors have shown up. They understood that this was a challenging time, there’s still COVID going on and harvest is occurring.”

Exhibitors agreed it was nice to see everyone again face-to-face and not through a computer screen or on a phone call.

“Everybody is glad to be here,” said Jay Perkins, inside sales manager for Essmueller. “Everybody we’re talking to is so glad to be shaking your hand and to be here physically. We’re just incredibly busy right now; everybody is busy compared to last year. There are a lot of big companies coming by that are high dollar customers, and what they’re saying is very positive. We’ve got a lot quoted to them, you just hope that what they’re telling you comes through.”

Projects have been moving at a rapid pace since late last year, said Brian Burmaster, senior vice president, global sales, Vortex.

“It’s been a fun year from an order standpoint but there have been some challenges on the supply side that we are certainly working hard to manage as best we can,” he said. “We’ve tried to manage it with investment in inventory, alternate suppliers, and working with suppliers to find alternate materials.

“Just being honest with customers is key for us. It’s usually not the first time they’ve heard there’s supply chain issues.”

AGI’s Jason Boyles, director, US commercial sales, said there’s definitely pent-up demand and agreed the supply chain is the biggest challenge.

“Main components like bearings, gear motors, those things are typically four weeks out under normal circumstances,” he said. “Now it’s closer to eight to 12 weeks.”

In some cases, there are parts that suppliers they can’t even get estimates for lead times, said Scott Vincent, district sales manager for Chief Agri.

“You can’t plan,” he said. “We’ve exhausted existing inventories in a lot of things. The supply lines are bad, transportation is tough and labor is horrendously bad right now.”

For Bühler, supply chain also has been an issue since many parts are sourced from other countries.

“It’s unpredictable and so are the shipping costs,” said Adrian Hinderling, senior sales executive, ship loading and unloading. “Generally speaking, business has picked up very, very well. 2021 kicked off very well and it looks pretty good into 2022. Lots of projects have been parked for a year and now they’re kicking off again.”

In addition to supply chain issues, suppliers are being challenged by skyrocketing steel prices. Vincent said there was a huge upsurge in storage orders early on, but as steel prices have progressed, there’s been a downturn.

Hot-rolled coil steel, which is used to make grain bin sidewall panels, was about $425 a ton in September and is now around $1,750 a ton, he said.

“A big commercial bin is on average, depending on how it’s outfitted and what accessories it has, is up anywhere from 45% to 55% since January,” Vincent said. “A million-dollar project is now a million and a half. I don’t see a breaking point in sight. We’ll be looking well into 2022; there’s nothing to say it’s going to come back down right now.”

Thanks to higher commodity prices and pent-up demand, 4B is as busy as it’s ever been, said Carl Swisher, sales manager, material handling. The challenge for them is finding workers.

“Our elevator bucket business is as good as it’s ever been,” he said. “Those are products that we make in Morton, Illinois. Our biggest challenge is finding people and keeping people. We’re probably looking for 10 to 15 people. There’s a fairly constrained labor market; we aren’t in a big city like Dallas or Chicago.”

Several suppliers agreed they could use more workers and are struggling to find them. Behlen is short about 150 people across the board.

“There’s a shortage of people; it’s everywhere,” said Jim Snyder, general manager, grain systems division. “We can’t find people to do engineering jobs all the way down to someone to sweep the floor.”

COVID-19 restrictions definitely changed the way suppliers communicate with customers and within their organizations. Many agree some of those changes are likely to stay, particularly those that provided time and costs savings.

“The inter company remote stuff will never go away and some of the external remote stuff will never go away,” Vincent said.

He recently completed a training session for a large dealer. He was at the dealership along with their people while three others joined via Zoom. In the past, those people would have been in-person.

“I think we were as effective,” he said. “People have become more and more comfortable with it. This never would have happened organically, or at least not to the state that we’re in now; this forced the issue.”

Bühler also pivoted its communication strategy, offering virtual meetings to showcase its products and creating a 360-degree virtual tour of its new Food Innovation Center in Plymouth, Minnesota, US.

“Now we have a nice 360-degree virtual tour that anyone can see,” said Kevin Rodriguez, sales account manager, grain quality. “We have that not just for customers but for us too, to know what is there.”