With harvest approaching in Northern Hemisphere growing regions and crop estimates being revised up as weather remains largely favorable, wheat has become cheaper recently.

The US Department of Agriculture (USDA) said in its June 10 Grain: World Markets and Trade report that “wheat prices fell across most major exporting countries since last month’s WASDE (the USDA’s monthly World Agricultural Supply and Demand Estimates report) with improving winter wheat conditions in several key producing regions.”

Russian export quotes have declined as the winter wheat harvest nears and remained flat since the new floating taxes became effective June 2, the USDA said, noting that its quotes are currently the most competitive.

“Argentine quotes have also declined slightly as planting is underway,” the report said. “US quotes declined after the last WASDE but have rebounded partially over the past week with some rains at harvest time.”

The USDA also reported a slight decline in Australian prices, limited because of robust offshore demand. There was a decline described as marginal in EU prices with old crop supplies tight, but favorable prospects for the new crop.

“In contrast, quotes from Canada have risen sharply over the past couple of weeks with a smaller expected crop,” the USDA said.

The USDA issued an updated WASDE report on June 11 that put the US 2021-22 wheat crop at 51.66 million tonnes, up from its May forecast of 50.95 million, with “increased hard red winter and soft red winter production more than offsetting lower white winter production.”

“The global wheat outlook for 2021-22 is for larger supplies, higher consumption, increased trade, and higher stocks,” the USDA said. “Supplies are projected to increase 4.3 million tonnes to 1.087.9 billion, mainly on higher production for the EU, Russia, and Ukraine as world production is projected at a record 794.4 million.”

The USDA’s previous forecast for the world’s wheat crop was 788.98 million tonnes.

“The EU is raised 3.5 million tonnes to 137.5 million on recent beneficial precipitation across Northern and Central Europe,” the USDA said. “The largest increases are for Germany, France and Romania.”

The USDA also increased its forecast for Russia’s wheat production by 1 million tonnes to a record 86 million.

“Winter wheat production is increased on a higher yield with widespread spring rainfall across Western Russia, while spring wheat is raised on higher area, based on Agricultural Ministry estimates,” the USDA said.

“The USDA added 500,000 tonnes to its forecast for Ukraine, bringing it to 29.5 million tonnes, another record, because of “favorable weather conditions.”

The USDA also is expecting record wheat consumption, having increased its forecast by 2.4 million tonnes to a record 791.1 million, mainly on higher feed and residual use by the EU and Russia, because of increased supplies. Trade in 2021-22 is also forecast at a record 203.2 million tonnes, a revision upwards of 800,000 tonnes in increased exports by Ukraine and India.

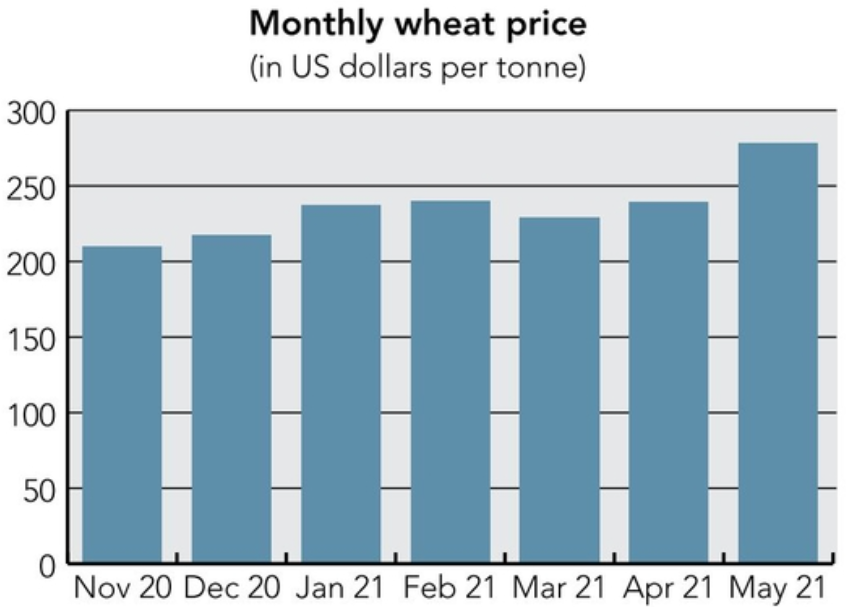

In its Grain Market Report at the end of May, the International Grains Council (IGC) said that “with day-to-day movements often linked to changes in other commodities, especially corn, world wheat export prices posted further gains in the first part of May, but retreated later in the month,” reporting a 5% fall since its previous report, a month earlier.

“Activity was somewhat volatile, often responding to changeable weather forecasts,” the IGC said. “Worries about dryness for crops in the US, Europe and the Black Sea region provided initial support, but concerns were partly allayed by widespread rains as the month progressed.”