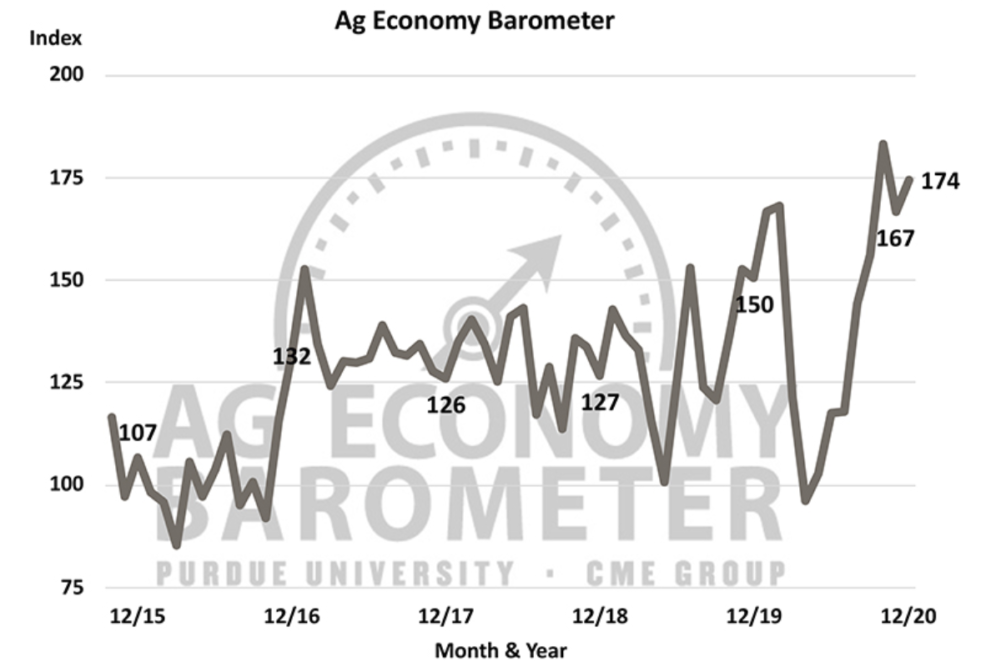

CHICAGO, ILLINOIS and WEST LAFAYETTE, INDIANA, US — There was a modest improvement in US producer sentiment in the last month of 2020, according to the latest Purdue University/CME Group Ag Economy Barometer.

The barometer increased 7 points from November to a reading of 174. Both the barometer's sub-indices — the Index of Current Conditions and the Index of Future Expectations — were also higher in December than in November. The Index of Current Conditions climbed 15 points to 202 and the Index of Future Expectations increased by 5 points to a reading of 161.

The Ag Economy Barometer is calculated each month from 400 US agricultural producers’ responses to a telephone survey. The December survey was conducted from Dec. 7-11.

“The rise in the Ag Economy Barometer was primarily driven by farmers’ perception that the current situation on their farms really improved,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “The sharp rise in the Index of Current Conditions is correlated with the farm income boost provided by the ongoing rally in crop prices. That appears to be the driving force behind producers' optimism.”

Producers were noticeably more inclined to think now is a good time to make large investments in their farming operations than in November. The Farm Capital Investment Index increased 13 points in December to a record high of 93. The percentage of farmers expecting to increase their machinery purchases in the upcoming year rose 5 points to 15% in December, while the percentage expecting to reduce their purchases declined by the same amount.

They were also bullish about farmland values and cash rental rates. In December, the percentage of farmers expecting farmland values to rise over the next year increased 9 points from November to a reading of 35. The percentage expecting farmland values to rise over the next five years increased 11 points from November to an all-time survey high 65%.

Reflecting the improvement in crop production profitability, more producers said they expect farmland cash rental rates to rise in 2021 when compared to survey results from late summer. In December, 18% of respondents said they expect cash rental rates to rise in 2021, double the percentage who felt that way in August and September. Moreover, it’s clear that any downward pressure on cash rental rates evident earlier in the year has nearly disappeared, as just 5% of farmers said they expect to see cash rental rates decline in 2021 compared to 17% who felt that way in August.

Farmers were less optimistic when asked about the on-going trade dispute between the United States and China. In the first quarter of 2020, an average of 76% of respondents thought the trade dispute’s ultimate resolution would favor US agriculture, by spring that average declined to 62%, and by December it dropped to an all-time survey low of 47%. When asked whether they expect US ag exports to increase over the next five years, only 51% of respondents in December said they expect to see export growth.

To learn more about what factors might be motivating the shift in producers’ sentiment pre- and post-November election, a series of questions focused on producers’ future expectations for environmental regulations, taxes and other key aspects of the agricultural economy, were included on the October, November and December surveys. In December, farmers continued to express concerns following the November election about several key policy issues affecting agriculture. More than 80% of farmers said they expect environmental regulations to become more restrictive in December, compared to 41% who felt that way in October. More than 70% of producers expect to see higher income and estate taxes compared to 35% and 40%, respectively, in October.

One-third of farmers said they expect the farm income safety net to weaken compared to 18%, and just over one-fourth of producers said they expect government support for the ethanol industry to weaken compared with 17% who felt that way in October.