The United States is the world’s largest grain producer and exporter and its biggest ethanol producer. Recent trade disagreements, however, have complicated life for U.S. exporters, particularly of soybeans, as the U.S. and Chinese governments fight over issues that go much wider than agricultural trade.

In its May 30 Grain Market Report, the International Grains Council (IGC), forecast total U.S. grains production in 2019-20 at 426.2 million tonnes, down from the prediction it made earlier this year of 434.8 million and compared with 431.6 million in 2018-19.

The IGC now puts U.S. wheat output in 2019-20 at 50.3 million tonnes, a forecast unchanged from a month earlier and down from 51.3 million in the previous year.

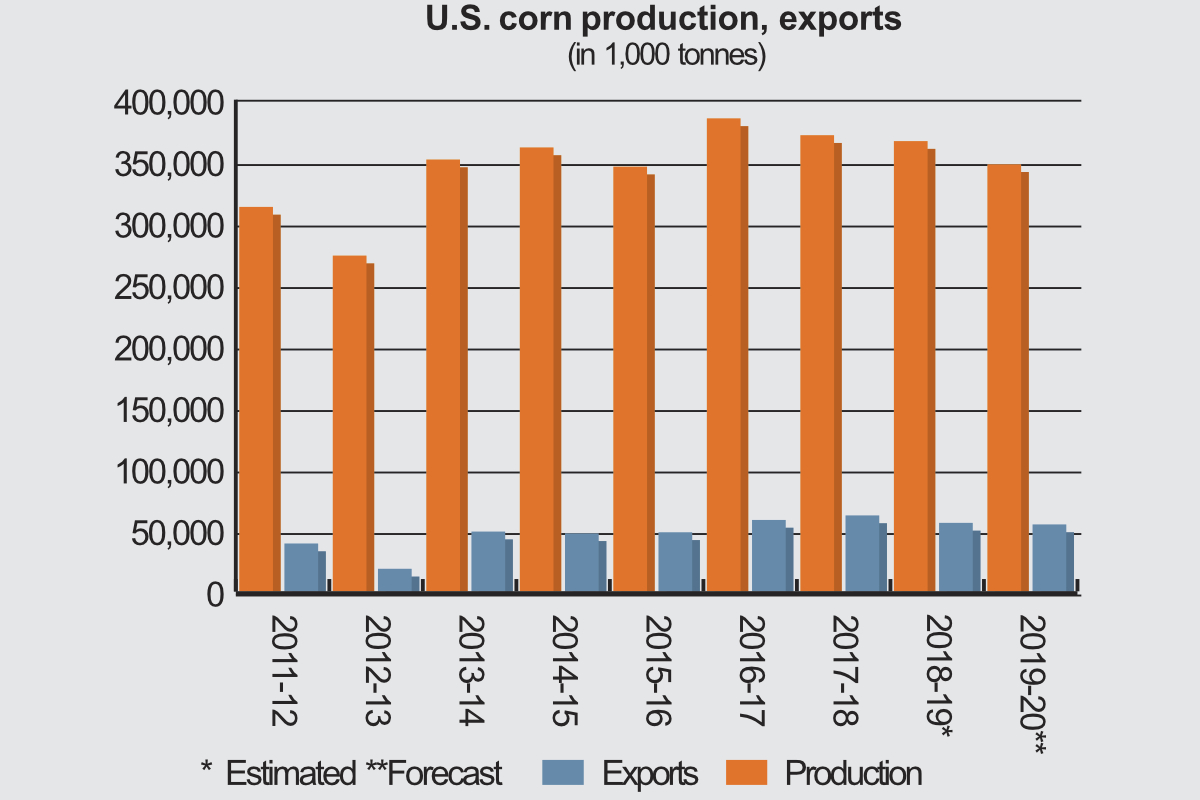

U.S. corn production is now forecast at 362.4 million tonnes in 2019-20, down from the 371.2 million predicted a month earlier. The previous year’s crop was 366.3 million tonnes.

Barley production in the United States in 2019-20 is forecast at 3.4 million tonnes, a figure unchanged from the previous month’s forecast. The 2018-19 crop was 3.3 million tonnes.

Production of sorghum is put at 8.5 million tonnes, a forecast unchanged from the month before, down from 9.3 million in 2018-19.

Total U.S. grain exports in 2019-20 are forecast at 84.8 million tonnes, down from the figure of 88 million the IGC predicted a month earlier and also down from the previous year’s 90.2 million tonnes.

U.S. wheat exports are forecast at 26 million tonnes in 2019-20, a downward revision from the figure of 27.1 million tonnes arrived at a month earlier, and also down from the 26.5 million tonnes exported in 2018-19.

U.S. exports of corn are forecast at 55.9 million tonnes, down from the forecast made the previous month of 57.9 million and also down from the 60.9 million tonnes exported in 2018-19.

Total U.S. grain imports in 2019-20 are forecast at 6.3 million tonnes, up from the previous estimate of 5.9 million tonnes and up from 5.7 million tonnes last year.

U.S. imports of wheat are forecast at 3.1 million tonnes, an estimate revised up from the figure of 2.8 million tonnes produced the month before, and up on the 3 million tonnes imported in 2018-19.

The forecast for U.S. corn imports in 2019-20 is unchanged at 1.1 million tonnes and compares with a figure of 800,000 tonnes for the year before.

The United States is also set to export 2.75 million tonnes of sorghum in 2019-20, according to the IGC, which had revised its forecast down by 50,000 tonnes. The previous year’s exports were 2.8 million. Imports are too small to register in the IGC’s predictions.

The IGC’s forecast for U.S. rice production is unchanged at 6.9 million tonnes, down from 7.1 million the year before. U.S. imports of rice are put at 800,000 tonnes, down from the previous estimate of 900,000 and the same as the previous year’s level. U.S. exports of rice are forecast at 3.3 million tonnes, down from 3.4 million forecast a month earlier, but up from the previous year’s 3 million tonnes.

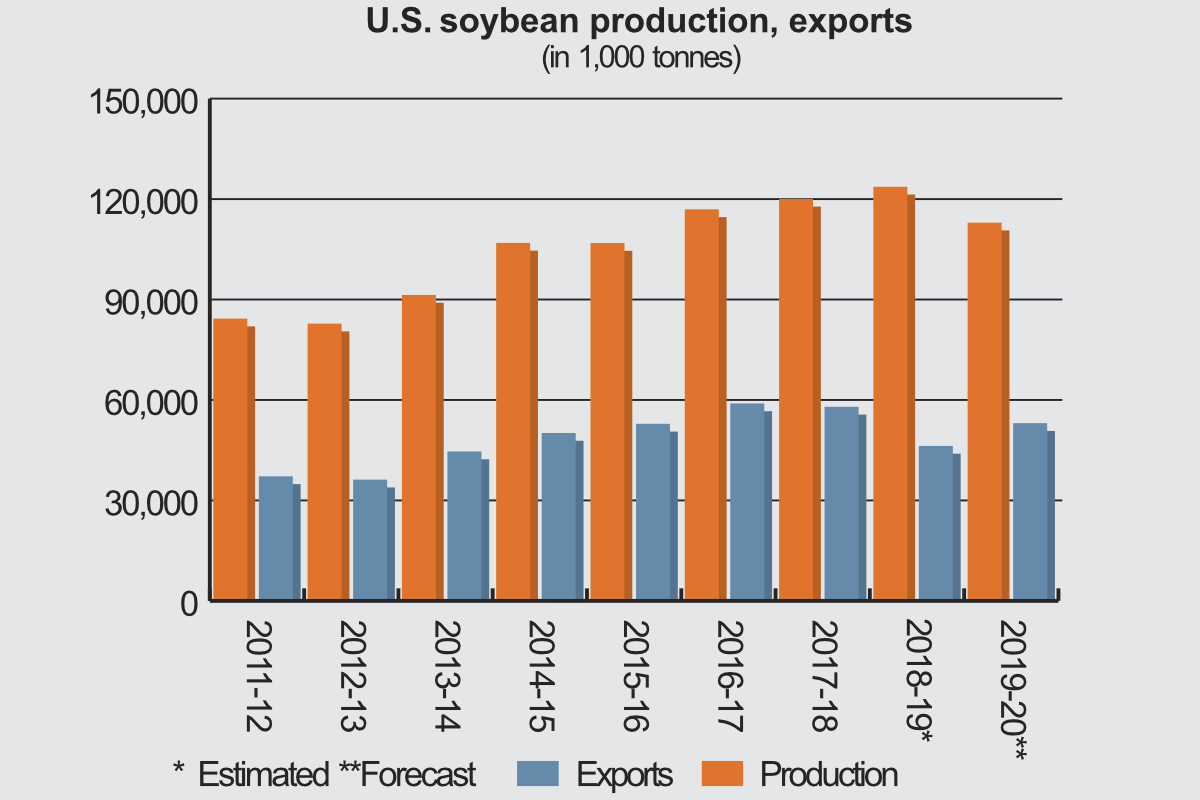

The IGC’s forecast for the U.S. soybean crop is unchanged at 114 million tonnes, down from 123.7 million the year before. U.S. rapeseed production is put at 1.5 million tonnes, down from the previous estimate of 1.6 million and 1.6 million the previous year.

U.S. soybean exports are put at 52.9 million tonnes, down from the previous forecast of 53.5 million, but up from 49.3 million the year before. The country’s exports of soymeal are put at 12.3 million tonnes, up from the previous estimate of 11.6 million tonnes and down from 12.5 million in 2018-19.

U.S. imports of rapeseed are put at 500,000 tonnes, unchanged from the previous estimate and the previous year’s crop. U.S. rapeseed exports are put at 200,000 tonnes, an unchanged estimate that compares with the previous year’s exports of 100,000.

Trade war with China

U.S. trade in grains and oilseeds has been disrupted by a series of disputes, notably with China, to the dismay of the country’s farmers. On June 11, Ben Scholz, president of the National Association of Wheat Growers, submitted testimony to the House Agriculture Livestock and Foreign Agriculture Subcommittee telling the politicians that “wheat farmers are facing an incredibly challenging economic environment and that trade disruptions have negatively impacted farmers.”

The U.S. administration’s dispute with China, which resulted in that country effectively blocking imports of U.S. soybeans, has had, perhaps, the most disruptive effect. The American Soybean Association on May 13 criticized “the lack of progress between the U.S. and China in resolving the trade war, which continues to immediately threaten soy prices and, if not resolved, farmers’ ability to stay in business.”

“The U.S. has been at the table with China 11 times now and still has not closed the deal,” said Davie Stephens, president of the ASA. “What that means for soybean growers is that we’re losing. Losing a valuable market, losing stable pricing, losing an opportunity to support our families and our communities.”

Flour milling

According to the 2019 Grain and Milling Annual, there were 164 mills in the United States in 2018, four fewer than in 2017. They have a total daily capacity of 1,579,036 cwts (71,624 tonnes). Seventy-two of the mills have a capacity of 10,000 cwts (454 tonnes) per day or more, while just 10 have a capacity of under 200 cwts (nine tonnes).

The largest mill in the United States is that of the North Dakota Mill & Elevator Association at Grand Forks, North Dakota, with a daily capacity of 52,500 cwts (2,381 tonnes), putting it far ahead of the second largest, the Ardent Mills mill at Hastings, Minnesota, which has a daily capacity of 32,500 cwts (1,474 tonnes).

However, Ardent Mills is the largest milling company, with a combined milling capacity of 496,800 cwts (22,534 tonnes), which includes rye and durum.

Biotech and biofuels

The United States has been an enthusiastic adopter of biotech in agriculture, particularly for soybeans and corn. According to the USDA’s Economic Research Service, 92% of corn planted in the United States in 2018 was stacked gene varieties, while 94% of soy was also genetically engineered.

On June 11, President Donald Trump signed an order calling for a streamlined regulatory system for biotech products and action against trade barriers. The Modernizing the Regulatory Framework for Agricultural Biotechnology Products Executive Order also says the regulatory system “must both foster public confidence in biotechnology and avoid undue regulatory burdens.”

The United States is the world’s largest producer of fuel ethanol, using, overwhelmingly, corn as a feedstock. In its 2019 Ethanol Industry Outlook, the Renewable Fuels Association said that, in 2018, “the nation’s 210 ethanol plants located across 27 states produced an astounding 16.1 billion gallons of clean-burning renewable ethanol.”

A move to legalize the year-round use of an E15 blend, finalized May 31, is expected to increase ethanol consumption.